PEO Alternative

If you are In a PEO, Contact us to Save Money by Becoming Independent

We have saved our clients an average of $1,000.00 per employee per year in unnecessary costs!!

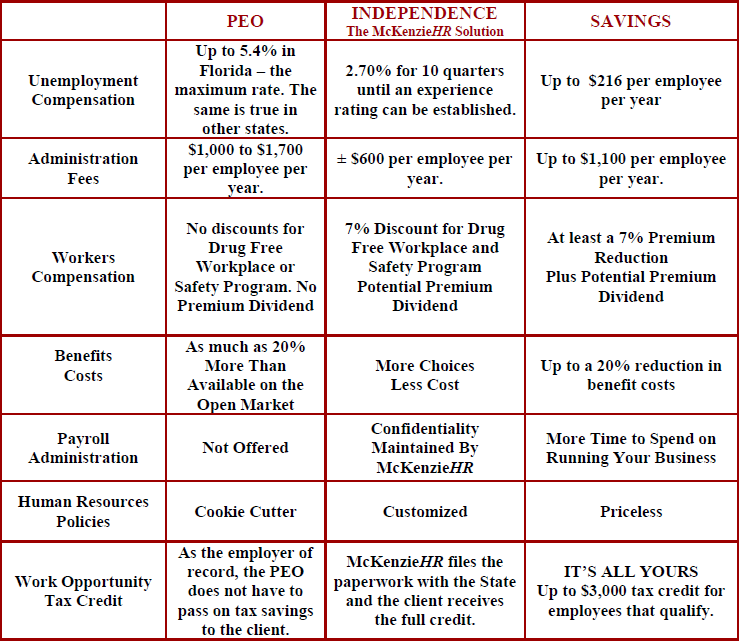

Employee Leasing, also known as Professional Employers Organizations or PEO’s, started out many years ago with a great concept. The primary objective of PEO’s was to sign up a number of small businesses so they could go to the group insurance carriers and negotiate better insurance rates and pass on the savings to their client companies. Under the concept, known as co-employment, the PEO becomes the Employer of Record for payroll, workers compensation, unemployment and group benefits, while the client company still manages the same employees on a day-to-day basis. This model worked very well for a while. However, in the last several years, the cost of being in a PEO has risen faster than the rest of the marketplace.

If you are in a PEO, Ask Yourself These Questions.

Then contact McKenzieHR for a free check-up.

Are your costs for administration fees, workers compensation, benefits and unemployment broken down separately on your bill?

If not, how do you know you what you are paying for?

Do you know the going rate for each of the above items?

If not, ask someone who does. (Hint – McKenzieHR knows)

Do you know how many clients your PEO Human Resources Representative is responsible for handling?

Most PEO HR Reps have over 100 clients they serve spread out over a large geographic area. McKenzieHR advisors have no more than 10 clients and are required to return a client’s call in no more than 3 hours.

Have you carved out your group benefits?

If so, you are experiencing first hand one of the examples of costs of being in a PEO has risen faster than the general marketplace. You are also defeating the purpose of being in a PEO.

Are you getting discounts on your workers compensation for implementing a drug free workplace and a safety program?

The quick answer to this question is “NO”. PEO’s do not offer these discounts.

Do you get a premium distribution on your workers comp premium when you have few claims?

The quick answer to this question is “NO”. PEO’s do not offer premium distributions.

Do you know what you are paying in Unemployment Taxes?

- Unemployment Compensation is both an insurance plan and a tax. Just like any insurance plan, the more unemployment claims that are charged to your account, the more you will have to pay in the form of unemployment taxes. Under a PEO arrangement, all of the employers under the PEO umbrella are included with your company.

- Gain Control – By being included in a large group of co-employees through the PEO, YOU have no control of YOUR unemployment taxes. If another company within the same PEO goes out of business and a large payout of unemployment is made by the PEO, your taxes will go up even if you did not lay anyone off.

- Pay Less – If you are paying more the introductory rate (2.7% in Florida – contact us for other states), then you may be overpaying your unemployment compensation tax.

- Stop Wasting Your Time – Appealing an unemployment claim under a PEO is a waste of time because you have no control on the overall level of claims.

Do You Get Full Credit for Work Opportunity Tax Credits?

The answer here is probably not. Since the PEO is the employer record, you as the client employer are not eligible to receive the tax credit. The PEO can pass some of the savings on to you, but they do not have to.

McKenzieHR takes care of the paperwork and reporting. YOU get 100% of the tax credit. The work we do for you is a part of our monthly fee.

Do any of the Human Resources Representatives with the PEO teach other HR Professionals on HR?

We can’t answer that. But we can say that Bob McKenzie has been facilitating classes for HR professionals seeking professional HR certification for over 12 years now – with a very high pass rate.

Contact Us for a Free Check-Up – McKenzieHR experts will take a look at your current bill and determine whether you are getting the best bang for your buck. What you do with this information is your business. No hard sell here.

Here’s How We Do It

By looking at each expense item separately, McKenzieHR will determine the amount of savings your organization will gain.